This question has no easy answer. At the outset, however, we will note that all estates under one million dollars are entitled to a full exemption from Massachusetts estate tax under current law. While there are no modifications on the horizon as of summer of 2012, the law may nevertheless change at any time.

This question has no easy answer. At the outset, however, we will note that all estates under one million dollars are entitled to a full exemption from Massachusetts estate tax under current law. While there are no modifications on the horizon as of summer of 2012, the law may nevertheless change at any time.

Every resident of the Commonwealth should know some basic information about the Massachusetts estate tax, because predicting whether and how much tax will be due upon one’s death is a very challenging task for the layperson. Shifts in property values, changes in the state or federal tax codes, and unanticipated inheritances are a few examples of the variables that contribute to this challenge. With this article we aim to soften the challenge a bit (may take a few reads).

(Read: Methods Estate Planning Attorneys Use to Reduce Estate Tax Liability)

General Rule: The dollar amount ranges listed below correspond to the adjusted taxable estate. To calculate one’s adjusted taxable estate we use the following formula: (Total Federal Gross Estate – Allowable Federal Deductions – $60,000).

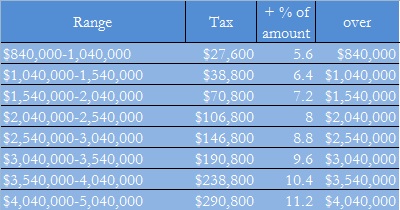

And so let’s look at an excerpt from the Massachusetts estate tax table. Below we have posted some of the marginal tax rates and tax liabilities associated with the values of progressively larger estates.

Take note that there are Massachusetts estate tax rates on estates valued below $1,000,000 down to $40,000. These rates will apply if the Massachusetts estate tax exemption is used up, or reduced for reasons we will get into later. But just for clarity, we are going to use hypothetical estate values to examine how much Massachusetts estate tax would be due when the full exemption is available:

Example 1: Mary passes away, leaving an entire estate valued at $2,100,500 after administrative and estate expenses. The total Massachusetts estate tax due on her estate would be $111,640, or $106,800 + $4,840 (8% of $60,500, the amount of the estate over $2,040,000).

Example 2: Sam passes away, leaving an entire estate valued at $3,940,000 after administrative and estate expenses. The total Massachusetts estate tax due on his estate would be $280,400 or $238,800 + $41,600 (10.4% of $400,000, the amount of the estate over 3,540,000).

Note that the above estate values are given after administrative and estate expenses. In the administration of an estate there are many services that the personal representative (formerly executor or administrator) will take advantage of. Expenses like the probate attorney, an accountant, a real estate agent employed to sell estate property, and other costs related to maintaining or managing the estate are some of the most common costs. As such, they are deducted from the value of the estate before calculating federal or Massachusetts state estate tax liability.

What is the Massachusetts Estate Tax if Gifts Have Been Made?

While there is no Massachusetts gift tax, one must be mindful that any gift of over $13,000 is considered a “lifetime gift” that reduces your Massachusetts estate tax exemption by the same amount. The purpose of course is to curb any attempts to avoid estate tax. But making a lifetime gift may still have a net positive effect on your overall estate tax due to the progressive marginal tax rate structure. The below examples illustrate how these tax savings are made:

Example 3: Mary at the age of 72 has a taxable estate of $2,400,000. Ten years later, at the age of 82, Mary dies leaving her entire estate of $2,100,500 after administrative expenses. The Massachusetts estate tax on Mary’s estate, as we already determined in Example 1 would be $111,640.

Example 4: Mary at the age of 72 has a taxable estate of $2,400,000. Over the next ten years, Mary makes taxable gifts of approximately $1,400,000, and leaves an entire estate of $1,000,000. Because the value of total taxable gifts made exceeds Mary’s $1,000,000 estate tax exemption, she now has $0 left in the Massachusetts estate tax exemption. The Massachusetts estate tax due on her estate according to the table above would be $36,560.

From the examples above, we see that Mary’s estate paid $75,080 less when she made lifetime gifts, than it would have paid if the gifts were not made. The savings are more dramatic with greater estate values.

How Do I Avoid the Massachusetts Estate Tax?

When someone passes away there really isn’t any way to avoid estate taxes, although certain estate plans can be drafted to allow for asset adjustments in order to maximize the exemptions made. Estate tax avoidance strategies are therefore mostly executed during the drafting of the estate plan itself. During our initial consultation, for example, we would assess potential estate tax liability and recommend various estate tax avoidance tools and devices tailored to a client’s situation.

Among the tools we use are lifetime gifting schedules – either outright or by the use of an LLC, the marital exemption, bypass and Q-TIP trusts, and Irrevocable trusts that contain anything from a home to a life insurance policy. Again, there are many options available in Massachusetts that should be tailored to each client’s particular circumstances. And often enough, avoiding Massachusetts estate taxes are not even the most important goal in an estate plan. For a preliminary report on your potential estate plan liability send an email to Atty.McNamara@Comcast.net or call us at 508-888-8100.

What about the Federal Estate Tax?

None of the information above takes into consideration the federal estate tax. For more information feel free to contact one of our experienced Cape Cod probate attorneys, or read our article on the federal estate tax.