One of the most frequent issues we deal with as estate and probate attorneys, is the problem of a fiduciary who does not honor his or her duty to beneficiaries. A fiduciary duty is a legal principle that binds the “fiduciary” to see to care for one person’s interest, typically a “beneficiary,” over and above that fiduciary’s own interest. This duty is particularly important where the fiduciary is also a co-beneficiary of an estate or trust, which is very often the case. The fiduciary titles in Massachusetts are referred to as a “personal representative” or “PR” for an estate, and “trustee” for a trust.

One of the most frequent issues we deal with as estate and probate attorneys, is the problem of a fiduciary who does not honor his or her duty to beneficiaries. A fiduciary duty is a legal principle that binds the “fiduciary” to see to care for one person’s interest, typically a “beneficiary,” over and above that fiduciary’s own interest. This duty is particularly important where the fiduciary is also a co-beneficiary of an estate or trust, which is very often the case. The fiduciary titles in Massachusetts are referred to as a “personal representative” or “PR” for an estate, and “trustee” for a trust.

What Are the Beneficiary’s Rights in an Estate or Trust?

While a PR and trustee owe an absolute fiduciary duty to their beneficiaries, they generally also have very broad discretion on how to carry out this duty. In most instances, this means that the beneficiary cannot simply make a demand and expect that the fiduciary take a particular action. Instead, a beneficiary is only entitled to request very specific items from the personal representative or trustee. Language in the trust will identify these items in detail, but initial requests are ordinarily made for: a copy of the trust itself, an “inventory” of assets, and an “account” of all trust activity.

How Does the Beneficiary Obtain This Information?

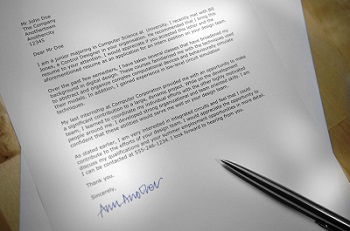

When requesting items of the Trustee or PR, a beneficiary’s best strategy is to communicate the request in writing. The form may be in traditional mail or e-mail, but it’s important that the beneficiary has a record of the timing of the request. Asking the fiduciary to respond within a certain period of time is fairly typical also, which should correspond to the complexity of the request; for example a copy of the trust should be a very easy response whereas generating an account would require some time, e.g. to calculate expenses and reconcile accounts. While fiduciary duty does not require that a PR or trustee act in any fixed period of time, the beneficiary should expect a response to information requests within a reasonable timeframe.

When requesting items of the Trustee or PR, a beneficiary’s best strategy is to communicate the request in writing. The form may be in traditional mail or e-mail, but it’s important that the beneficiary has a record of the timing of the request. Asking the fiduciary to respond within a certain period of time is fairly typical also, which should correspond to the complexity of the request; for example a copy of the trust should be a very easy response whereas generating an account would require some time, e.g. to calculate expenses and reconcile accounts. While fiduciary duty does not require that a PR or trustee act in any fixed period of time, the beneficiary should expect a response to information requests within a reasonable timeframe.

What Happens if the Trustee or Personal Representative Ignores All Requests?

The next course of action will greatly depend on the circumstances, but a beneficiary who experiences difficulty with a trustee or PR would likely benefit from hiring an experienced estate and trust attorney specialist as soon as possible. General practitioners may be familiar with negotiation tactics, but a specialist in Massachusetts estate and trust law can leverage his or her knowledge with the laws – which are actually fairly new. The attorney can then weigh all options, and choose the best and fastest path forward to achieve the beneficiary’s goals. Most times this representation will begin with a letter from the attorney to the Massachusetts trustee or PR, or his or her attorney, with specific references to the duties of that fiduciary’s position, and of course specific requests made by the beneficiary. More often than not, this letter will lead to some communication and movement by the fiduciary.

Next Steps for the Beneficiary – After the Fiduciary’s Response

If the PR or trustee responds, the beneficiary together with the trust and estate attorney decides whether the response was adequate, and request additional information if needed. Then, if progress is made there may be an exchange between the parties, to craft a meaningful path forward that meets both the needs of the beneficiary and the obligations of the trustee. If instead the fiduciary did not respond, or is not meeting his or her obligations to the beneficiary, the next step may require Court intervention.

How Can the Court Address Problems with a Massachusetts Trustee or PR?

The Court may take any action requested by the beneficiary. There are a number of different strategies available for an experienced estate attorney to petition the Court in a probate matter, but they must correspond to the problem at hand to be successful: demanding sureties, requesting supervised administration, removal of the fiduciary and more. The upside of entering a probate case is that there are no court fees. There are similar options available for petitioning against the trust or trustee, but a filing fee to the Court must be paid to introduce the matter.

In summation, fiduciary duties are very simple and commonplace in everyday life, but where few are familiar with them, they are also frequently abused. Beneficiaries nevertheless have valid rights under trusts and estates, and a good fiduciary should honor them with diligence and regular communication. Contacting an experienced Massachusetts trust and estate attorney can be a critical source of support for those with concerns about their beneficial interests, or the behavior of a trustee or personal representative.