Probate Process

Ask us your legal questions

Contact Us

Cape Law

54 Market Street

(Inside Mashpee Commons)

Mashpee, MA 02649

Mailing Address:

PO BOX 2154

Mashpee, MA 02649

Phone: 508-888-8100

Fax: 866-638-8480

What is Probate Process? – An Introduction by a Cape Cod Probate Attorney

First things first. Probate is conducted entirely within the court system, i.e. the Massachusetts Probate and Family Court. Paying state estate tax has nothing to do with the probate process, nor does paying federal estate tax. Probate is not involved with any assets that are jointly owned or that have beneficiary designations, like a joint checking account or a life insurance policy.

Then what is Probate? “Probate” generally is the process by which the estate of a deceased person (“decedent”) is distributed through the legal system. It is the part of the legal system that determines and handles the fair and orderly distribution of debts, obligations and benefits after a person dies.

Whether or not a valid last will and testament is in place has no bearing on whether or not property goes through probate. What matters is how estate assets are titled. All property, in the name of the decedent only, will go through probate process regardless. Property not covered by a valid will is probated according to Massachusetts laws of intestacy, whereas property covered by a valid will is distributed according to the will’s terms.

Additionally, the probate process is much the same whether someone dies with a will or without a will (intestate), and under the new Massachusetts Uniform Probate Code (“UPC”), the personal representative oversees the process. The attorney for an estate in the probate proceeding is usually serving on the personal representative’s behalf. Handling the various claims, asset transfers, court procedures can be an overwhelming task for the layperson so that engaging an attorney with probate experience can be very valuable towards protecting assets.

Who Can Serve As the Personal Representative? Priorities Outside of a Will

If the will nominates a Personal Representative, that person will normally be the one to serve in that capacity. But if there is no will, or if the nominated person is unable or unwilling to serve the below priority appointment will be followed:

- The surviving spouse of the decedent who is also a devisee in the will.

- Other devisees in the will.

- The surviving spouse of the decedent.

- Other heirs of the decedent.

- If there is no known spouse or next of kin, a public administrator is appointed.

In any appointment, the person will not be qualified to serve as a personal representative for the probate of the will if 1) He or she is under 18, or 2) The Massachusetts Probate Court in the relevant county finds, in a formal proceeding, the appointment would be contrary to he best interests of the estate.

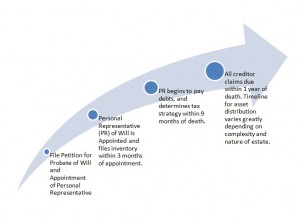

What Happens in the Probate Process?

Fundamentally, probate was designed to take care of two main functions that are fairly simple, but legally murky when someone dies:

- Paying debts and obligations that are owed; and

- Giving away assets to the beneficiaries.

In Massachusetts, the probate process will take place in the probate court of the county where the decedent was a resident. The estate of an individual domiciled on Cape Cod, for example, would go through Barnstable County Probate Court. Under the new Massachusetts Uniform Probate Code, the process takes place in one of two tracks; Informal and Formal. The probate process might take place in one or both of these tracks. Below are some general differences between the two probate process tracks:

- Formal requires service and publication of Citation before the appointment, Informal does not.

- Informal can use pre-printed court forms for pre- and post- filing notice, formal can not.

- Formal requires court (judge) for proceedings, informal uses court appointed magistrates.

- Formal probate can streamline the transfer of real estate whereas informal can slow the process.

- Formal provides a more certain closure of the estate (1 year), whereas informal can be reopened for up to three years.

Does the Executor Have to Pay All Debts First?

For the most part, all creditors are entitled to their claims before beneficiaries get their share of an estate. How and when these are paid, however, can significantly impact the amounts due to those who stand to benefit. It may be difficult, for example, for a personal representative to determine which debts are valid and which are not. The law requires that valid debts be paid in the following priority:

- Estate Administration (All Costs Associated with the Probate Process)

- Family Allowances (Homestead Exemption, Elective Share, Certain Family Support Funds)

- Funeral/Burial Expenses

- Taxes

- Secured Debts (Liens or Other Debts Attached to Assets)

- Unsecured Debts (Credit Card and Other Unattached Debts)

Attorneys can save the estate money by determining whether and when debts become valid, or “perfected.” It is not uncommon for many out-of-state creditors to come out of the woodwork upon a person’s death. We typically advise clients not to pay any debts of the decedent for at least 6 months. At around that time, we compile any outstanding bills and advise payment according to priority and validity.

What are Non-Probate Assets?

As we mentioned in the beginning there are a number of financial instruments and legal provisions that will keep assets completely out of the probate process; meaning they will pass directly to named person. A home that is owned jointly with rights of survivorship, for example, will pass to the survivor. Other such assets include joint checking accounts and life insurance policies.

The most frequently created non-probate assets are of course trusts, both revocable or irrevocable. For a more extensive treatment on this subject you may check out the article How to Avoid Probate in Massachusetts under our estate planning section.

Finding a Cape Cod Probate Attorney

Is as easy as giving us a call. Our office has experience working with both the Barnstable and Plymouth Probate courts, and we encourage you to contact one of our Cape Cod probate attorneys for a free consultation on your particular probate situation.

More Resources on Cape Cod and Massachusetts Probate Process

Does an Executor of the Will Need an Attorney?

How to Contest a Will

What is the Estate Tax in Massachusetts?

Ask us your legal questions

Contact Us

Cape Law

54 Market Street

(Inside Mashpee Commons)

Mashpee, MA 02649

Mailing Address:

PO BOX 2154

Mashpee, MA 02649

Phone: 508-888-8100

Fax: 866-638-8480

kf5abi

ip62wv

0ti76h

iaw8g4

31rnv5

936z5j

y201h8